Table of Contents

ToggleInvest in Goa: The Definitive Guide to Wealth Creation With Beachfront Real Estate

Imagine this: waking up to the sound of waves, sipping coffee while overlooking the Arabian Sea, and knowing that each sunrise adds not only to your peace of mind but also to your bank account. For thousands of investors, that dream turned into reality when they chose to invest in Goa.

Goa, once synonymous only with tourism, has now cemented itself as one of India’s fastest-growing real estate destinations. With demand for Goa beachfront properties at an all-time high, appreciation rates surpassing those of metro cities, and rental yields driven by tourism, this tiny coastal state has become a long-term wealth creation strategy.

If you’ve ever wondered whether now is the right time to invest in Goa real estate, this comprehensive guide will show you why the answer is a resounding yes.

Why Investors Worldwide Are Choosing to Invest in Goa

For decades, Mumbai, Delhi, and Bangalore were considered the only serious markets for property investors. But times have changed. Goa has emerged as the crossover between lifestyle and wealth creation, attracting NRIs, HNIs, and young professionals.

Here’s why:

1. Appreciation Outpaces Metro Cities

Land in North Goa’s beach belts (Vagator, Anjuna, Calangute) appreciated 12–15% annually (2020–2024).

In South Goa, luxury villas in Colva have seen a 40% growth in just five years.

By contrast, average property appreciation in Delhi-NCR hovered at 6–8% annually.

👉 Explore Goa Plots for Sale to track appreciation trends by region.

2. Tourism = Rental Goldmine

Goa welcomed 8.9 million tourists in 2023, including 500,000 international visitors (Goa Tourism Department).

Rental yields on beach villas: ₹20,000–₹70,000 per night.

Annual ROI via rentals: ₹25–60 lakh per villa.

👉 Try our ROI Calculator for Goa Real Estate Investments to estimate income potential.

3. Lifestyle Magnet for NRIs & HNIs

NRIs from Dubai, Singapore, and London are rushing to buy luxury villas in Goa.

Goa ranks among the Top 5 Holiday Home Destinations in India (MagicBricks 2024).

North vs South Goa: Where Should You Invest in Goa?

Not all of Goa is created equal for investors. Each belt has a unique value proposition:

North Goa – Rental ROI Leader

Hotspots: Anjuna, Vagator, Baga, Calangute.

Investor profile: Short-term rental seekers.

Income potential: ₹18,000–₹70,000 per night.

South Goa – Luxury Appreciation Zone

Hotspots: Colva, Palolem, Benaulim, Agonda.

Investor profile: Buyers looking for privacy and long-term value.

Appreciation: Villas in Colva appreciated 40% (2019–2024).

👉 Read our Luxury Villas in Goa Investment Guide to compare locations.

ROI Breakdown: How to Build Wealth When You Invest in Goa

When you acquire Goa beachfront properties, your returns compound across three layers:

1. Capital Appreciation

Average growth: 10–15% annually.

Beach-facing plots appreciate 2–3x faster than inland properties.

2. Rental Yield

Goa rental yield: 6–9%, versus 2–3% national average.

Airbnb-style rentals outperform long-term leases.

3. Resale Premium

Beachfront villas command 30–40% higher resale value.

Scarcity: The Hidden Driver Behind Goa’s Value

Why are investors confident that Goa beachfront properties will keep rising in value?

- CRZ (Coastal Regulation Zone) norms strictly limit beachfront construction.

- Only 3% of all new real estate approvals in Goa (2024) were beachfront.

- This extreme scarcity ensures demand always outstrips supply.

👉 Secure compliant projects with Legal Assistance for Property Purchase.

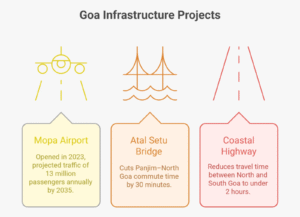

Infrastructure Growth: How Goa’s Roads, Bridges & Airports Add Value

Market Snapshot 2025: What numbers say before you invest in Goa

Occupancy & ADR: Third-party datasets indicate mid-to-upper mid short-stay occupancy in Goa, with ADRs that support solid gross yields. A typical short-term rental is booked ~172 nights/year, with ADRs ranging from ₹4,000 to ₹7,500, depending on the class and location. (Different panels report different cuts; use them as directional inputs alongside your own comps.)

Capital values: Coastal belt villas and gated communities in Anjuna, Vagator, Calangute, and Candolim saw the sharpest premium shifts.

Absorption: Launch-to-sale cycles for boutique luxury products have compressed, especially in North Goa’s prime panchayats. (Cross-check with live listings/indices for micro-area reality.)

Use these numbers to frame your underwriting as you invest in Goa—but always validate with fresh comps on your exact street.

A Real-World Goa Investor

Investor: Priya Mehta (NRI, Singapore)

- Purchase: 3BHK villa in Vagator (₹3.2 crore, 2020).

- Rental Income: ₹50 lakh annually via Airbnb.

- Resale Value (2025): ₹5.1 crore.

- ROI: 60% appreciation + 15% annual rental = 18% CAGR.

This is what happens when you invest in Goa early and strategically.

Smart Tips for Investors Who Want to Invest in Goa

✔️ Target emerging belts like Morjim & Agonda before prices peak.

✔️ Ensure dual income potential (short-term rental + long-term stay).

✔️ Diversify into both North Goa rentals and South Goa luxury villas.

✔️ Hire property managers to maximise rental income.

Legal & Compliance: The Must-Know Guide

Buying in Goa is rewarding, but only if done right.

- ✅ Check title deed & survey number.

- ✅ Verify CRZ clearance.

- ✅ Buy from RERA-registered developers.

- ✅ Work with legal advisors like TOTL Realty.

👉 Legal Assistance for Property Purchase – TOTL ensures safe, compliant investment.

FAQs

Q1. Is now a good time to invest in Goa or should I wait?

Now is structurally attractive: tourism is expanding, Mopa is scaling, and CRZ keeps supply tight. Waiting usually means paying more for the same micro-location.

Q2. What ROI can I expect if I invest in Goa for rentals?

Directionally, gross yields of 6–12% are achievable with professional operations; net outcomes hinge on ADR, occupancy, and opex control. Validate with belt-specific comps before commitment.

Q3. Which belts are best for first-time investors?

North belts (Anjuna–Vagator–Candolim) for rental velocity; South belts (Colva–Majorda–Agonda) for luxury serenity and long-stay wellness.

Q4. Are Goa beachfront properties legally safe to buy?

Yes—if CRZ, title, zoning, and RERA checks are clean. Always verify survey numbers and approvals pre-token.

Q5. Can NRIs invest in Goa?

Yes. NRIs can buy residential property under FEMA. Prepare for TDS at the sale and repatriation documentation.

Q6. How much budget do I need to invest in Goa?

As a directional band: premium apartments ~₹80L–1.5Cr; villas ~₹2.5–6Cr+ depending on belt, plot, and finish quality. Validate with current listings and deals.

Q7. What kills returns after I invest in Goa?

Weak operations, poor guest experience, non-compliant titles, noisy neighbourhoods, and under-investing in maintenance.

Q8. How do I choose between 3BR vs 4–5BR villas?

Larger villas tend to yield higher ADR for groups but incur higher operating expenses—model both against your target occupancy.

Q9. What about monsoons—will occupancy crash?

Seasonality exists, but strong branding, longer-stay packages, and corporate/wellness tie-ups help maintain the base load.

Q10. Will Mopa Airport really move the needle for my rentals if I invest in Goa?

Increased connectivity typically widens the traveller funnel; accommodation winners are those with top reviews and smoother access.

Q11. What’s the difference between sea-view and true beachfront in value?

Accurate beachfront (compliant) is rarer and tends to command higher resale premiums; sea-view can be a value hack if walkability is excellent.

Q12. Are gated communities better for investors than stand-alone villas?

For remote owners, yes—bylaws, security, standard area maintenance, and community rules help preserve guest experience and asset value.

Why Now Is the Time to Invest in Goa

The market for Goa beachfront properties is at an inflexion point. With infrastructure growth, limited supply, and booming tourism, investors who move now will reap compounding returns for years to come.

At TOTL Realty, we help investors unlock the right opportunities, ensure legal compliance, and maximise ROI. If you’re serious about building wealth, the most brilliant move you can make in 2025 is simple: Invest in Goa.