Table of Contents

ToggleLand Investment in India 2025: How the ₹10 Lakh Cr Infra Push Is Securing Long-Term Wealth Growth

The Great Indian Land Revival

India is entering a new era of transformation, where Land Investment in India has become a cornerstone of wealth creation. As the government injects a record ₹10 lakh crore into infrastructure, it’s not just roads and airports that are being built — it’s long-term prosperity.

In 2025, the link between India’s infrastructure investment and Land Investment in India is undeniable. Each new highway, metro route, and airport increases land value exponentially. While stocks fluctuate and gold glitters briefly, land quietly multiplies wealth.

At TOTL Realty, we see this as a defining decade for serious investors. By combining government-backed data, economic forecasting, and local insight, we help you discover Land Investment Opportunities in India that grow with the nation’s infrastructure.

As India urbanizes at an unprecedented pace, the next wave of millionaires will be those who invest where development begins — not where it ends. With the Land Investment in India ecosystem evolving through technology, transparency, and policy reforms, 2025 stands as the perfect year to turn plots into long-term prosperity.

Why Land Investment in India Is Gaining Unstoppable Momentum

Real estate in India is undergoing a structural shift. But within it, Land Investment in India has emerged as the most dynamic, stable, and inflation-resistant form of wealth building.

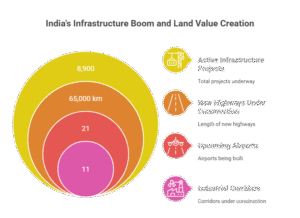

In the Union Budget 2025, the Government of India committed ₹10 lakh crore to infrastructure development (Ministry of Finance – indiabudget.gov.in). This massive investment covers expressways, airports, railways, and logistics parks — every one of which boosts surrounding land values.

As per Ministry of Road Transport and Highways (morth.nic.in), over 65,000 km of new highways will be operational by 2026. History proves that regions along these projects experience 150–300% land appreciation within a decade.

TOTL Realty’s on-ground data confirms that Land Investment in India near major corridors consistently outperforms built real estate, delivering returns up to 20–24% annually when held long term.

India Infrastructure Investment 2025: The Engine Behind Growth

The India Infrastructure Investment 2025 roadmap, led by the National Infrastructure Pipeline (NIP) (indiainvestmentgrid.gov.in), includes over 8,900 active projects worth ₹111 lakh crore. Each project represents a new wave of Land Investment in India, offering investors early-mover advantages.

Key programs shaping land appreciation:

PM Gati Shakti Mission: Creates synchronized connectivity across road, rail, port, and air transport.

Bharatmala Pariyojana: 34,800 km of new highways directly boosting Land Investment Opportunities in India.

Sagarmala Programme: Enhancing port infrastructure for trade-led land appreciation.

Smart Cities Mission: Urban transformation driving long-term real estate demand.

Industrial Corridor Projects: From DMIC to CBIC — the backbone of Long-Term Real Estate Investment India.

Each initiative directly links infrastructure expansion with Land Investment in India, turning once-remote areas into tomorrow’s economic hubs.

How Infrastructure Translates to Long-Term Wealth

The power of Land Investment in India lies in its long-term value creation. Land is finite, yet India’s infrastructure growth is infinite — and that mismatch creates consistent appreciation.

Accessibility Boost: Roads, expressways, and airports make remote land reachable, triggering new residential and industrial demand.

Utility Enhancement: With government-backed expansion of water, power, and digital networks, once-barren plots become development-ready.

Population Shift: Affordable housing and job opportunities near new corridors lead to population migration, increasing land absorption.

Economic Multiplier: New projects attract businesses, institutions, and retail, driving exponential land value growth.

Simply put: when infrastructure expands, land wealth follows.

TOTL Realty’s internal analysis shows that plots located within 10–20 km of major infrastructure projects deliver an average ROI of 18–25% per annum. That’s why Land Investment in India remains unmatched for long-term wealth generation.

Emerging Corridors Creating Land Investment Opportunities in India

India’s growth is not confined to metros anymore. Tier-2 and Tier-3 corridors are driving the next wave of wealth.

Delhi–Mumbai Industrial Corridor (DMIC): India’s largest infrastructure initiative connecting six states.

Nagpur–Goa Expressway: ₹83,600 crore project revolutionizing western connectivity and Land Investment in India potential.

Bengaluru–Chennai Expressway: Linking two tech capitals and sparking commercial land demand.

Amritsar–Kolkata Industrial Corridor: Expanding Eastern India’s logistics networks.

Mopa & Navi Mumbai Airport Zones: Boosting tourism and residential investments.

TOTL Realty’s corridor intelligence helps investors identify Land Investment Opportunities in India that align with infrastructure timelines.

Government Policies Strengthening Land Investment in India

The government is not just investing — it’s enabling investors. These key policies are making Land Investment in India safer, faster, and more transparent:

Digital India Land Records Modernization Programme (DILRMP): Ensures verified land titles.

National Monetisation Pipeline: Unlocks value from public assets for private participation.

PMAY Urban & Rural: Creates sustained housing demand.

National Logistics Policy 2022: Improves freight efficiency, fueling land value growth.

Industrial Corridor Development Program: Catalyzes industrial land appreciation.

Smart Cities Mission & AMRUT 2.0: Encourages urban-centric land investment.

Each policy makes Land Investment in India more predictable and profitable.

TOTL Realty Insight: How to Select High-Value Land Investments

At TOTL Realty, our data-backed framework for evaluating land includes five critical pillars:

Evaluation Pillar | Key Factor | Investor Impact |

Connectivity Index | Expressways, metro, airport proximity | Enhances liquidity & resale value |

Legal Clarity | Verified RERA and mutation records | Prevents title disputes |

Zoning & Use Classification | Residential, commercial, or mixed-use | Determines ROI potential |

Infrastructure Linkage | Alignment with Gati Shakti grid | Predicts long-term appreciation |

Future Triggers | Industrial, tourism, or education projects | Drives secondary demand |

Key Policies Powering Land Investment in India

Government initiatives directly supporting Land Investment in India include:

National Monetisation Pipeline – Unlocking value from public assets for reinvestment.

Digital India Land Records Modernization Programme (DILRMP) – Transparent, tech-enabled land ownership tracking.

PMAY (Urban & Rural) – Housing demand increasing residential land absorption.

Industrial Corridor Development Program – Boosting land demand near manufacturing zones.

National Logistics Policy 2022 – Cutting logistics cost to 8% of GDP, enhancing trade-linked land values.

The TOTL Realty Advantage

At TOTL Realty, we combine technology, transparency, and trust to guide your Land Investment in India journey.

Why investors trust us:

✅ AI-Powered Infra Mapping: We correlate infrastructure projects with land appreciation potential.

✅ Due Diligence Support: RERA, mutation, and legal verification done in-house.

✅ Local Market Intelligence: Ground surveys, GIS mapping, and demographic analytics.

✅ Custom Investment Reports: Tailored to individual ROI goals and time horizons.

✅ End-to-End Transaction Support: From identification to documentation.

FAQs: Land Investment in India 2025

Q1. Is 2025 really the best year for Land Investment in India?

Absolutely. With India’s largest-ever infrastructure budget and growing digital transparency in land records, 2025 is the perfect blend of opportunity and accessibility for investors.

Q2. What’s the ideal time horizon for Long-Term Real Estate Investment India?

Between 7–10 years. This timeframe allows investors to benefit from both completion of infrastructure and subsequent demand cycles.

Q3. How do I verify a land title?

You can use the Digital India Land Records Modernization portal (dolr.gov.in) or state-specific online registries. TOTL Realty assists in end-to-end title verification.

Q4. Which regions offer top Land Investment Opportunities in India?

Maharashtra, Goa, Gujarat, and Tamil Nadu lead 2025 projections, with strong infrastructure growth and investor interest.

Q5. What risks should I consider before investing?

Delays in infrastructure projects, unclear zoning, and liquidity issues. TOTL Realty mitigates these by recommending verified projects aligned with the India Infrastructure Investment 2025 roadmap.

The Future of Land: Holding the Asset That Outlives Inflation

In uncertain times, tangible assets like land are the ultimate hedge. While inflation erodes currency and market volatility tests investors, land continues to quietly appreciate — especially when backed by government infrastructure expansion.

TOTL Realty forecasts that the next five years will witness a 3x surge in land demand near logistics, industrial, and coastal corridors. As India aims for a $7 trillion economy by 2030, land remains the base layer of national wealth creation.

For those who enter now, Land Investment in India isn’t just an investment — it’s a legacy.

Call-to-Action: Build Your Legacy with TOTL Realty

The ₹10 lakh crore infrastructure wave is shaping India’s next decade. Don’t watch from the sidelines — own a piece of the transformation.

📍 Explore verified plots & corridors: www.totlrealty.com/invest

📞 Book your consultation: www.totlrealty.com/contact

📧 Talk to an advisor: info@totlrealty.com

TOTL Realty helps you turn infrastructure momentum into long-term wealth.

Invest early. Invest smart. Invest with TOTL Realty.