Table of Contents

ToggleThe Strategic 2026 Shift: Premium Land Investment India 2026 Decoded

India’s macroeconomic cycle in 2026 is not dramatic — it is disciplined. After navigating inflationary pressures, global volatility, and liquidity tightening over the past few years, the Reserve Bank of India (RBI) has signaled calibrated normalization in its rate stance. For seasoned investors, this is not just a policy update. It is a structural moment.

Rate pivots historically reshape asset allocation behavior. Capital begins repositioning — quietly, strategically — toward assets that combine scarcity, resilience, and long-term optionality. In this context, premium land investment India 2026 is being evaluated not as speculation, but as a strategic hedge within diversified wealth portfolios.

For HNIs, family offices, and long-horizon investors, the question is not “What is trending?” but rather, “What preserves purchasing power while aligning with India’s infrastructure and urban expansion story?”

This article examines why premium land investment India 2026 is emerging as a compelling thesis — grounded in monetary policy, capital expenditure momentum, governance reform, and structural scarcity.

The RBI Rate Pivot: Understanding the 2026 Monetary Context

The Reserve Bank of India’s Monetary Policy Committee (MPC) operates within an inflation-targeting framework of 4% ± 2%. Over recent cycles, the RBI maintained a measured tightening approach to stabilize inflation and preserve macroeconomic credibility.

Official policy releases and rate decisions can be accessed directly via the RBI.

As inflation trends moderated within tolerance bands and growth remained resilient, the policy stance began reflecting calibrated normalization rather than aggressive tightening.

Historically, when monetary cycles shift from tightening to neutral or accommodative phases:

- Liquidity expectations improve

- Borrowing costs stabilize

- Long-duration assets begin repricing

- Real assets attract patient capital

This environment creates fertile ground for premium land investment India 2026, particularly among investors seeking strategic asset rotation rather than short-term yield chasing.

How Rate Cycles Influence Real Asset Allocation

Interest rates directly affect capital flows. When the cost of capital stabilizes or begins easing:

- Developers secure land banks ahead of construction demand.

- Institutional investors lock supply in growth corridors.

- HNIs diversify toward tangible, non-depreciating assets.

Unlike equities — which react instantly to policy signals — land markets respond through gradual, infrastructure-aligned appreciation cycles.

In past rate transitions (mid-2000s and post-2013 phases), land values in strategic corridors appreciated ahead of broader residential inventory. This cyclical behavior strengthens the analytical foundation for premium land investment India 2026.

Liquidity rarely chases finished apartments first. It often secures land supply before the next construction wave accelerates.

The Infrastructure Multiplier: Union Budget 2026–27

A defining feature of India’s macro story is public capital expenditure. Union Budget allocations consistently prioritize infrastructure-led growth.

Official documentation and budget allocations are available here.

India’s capex push supports:

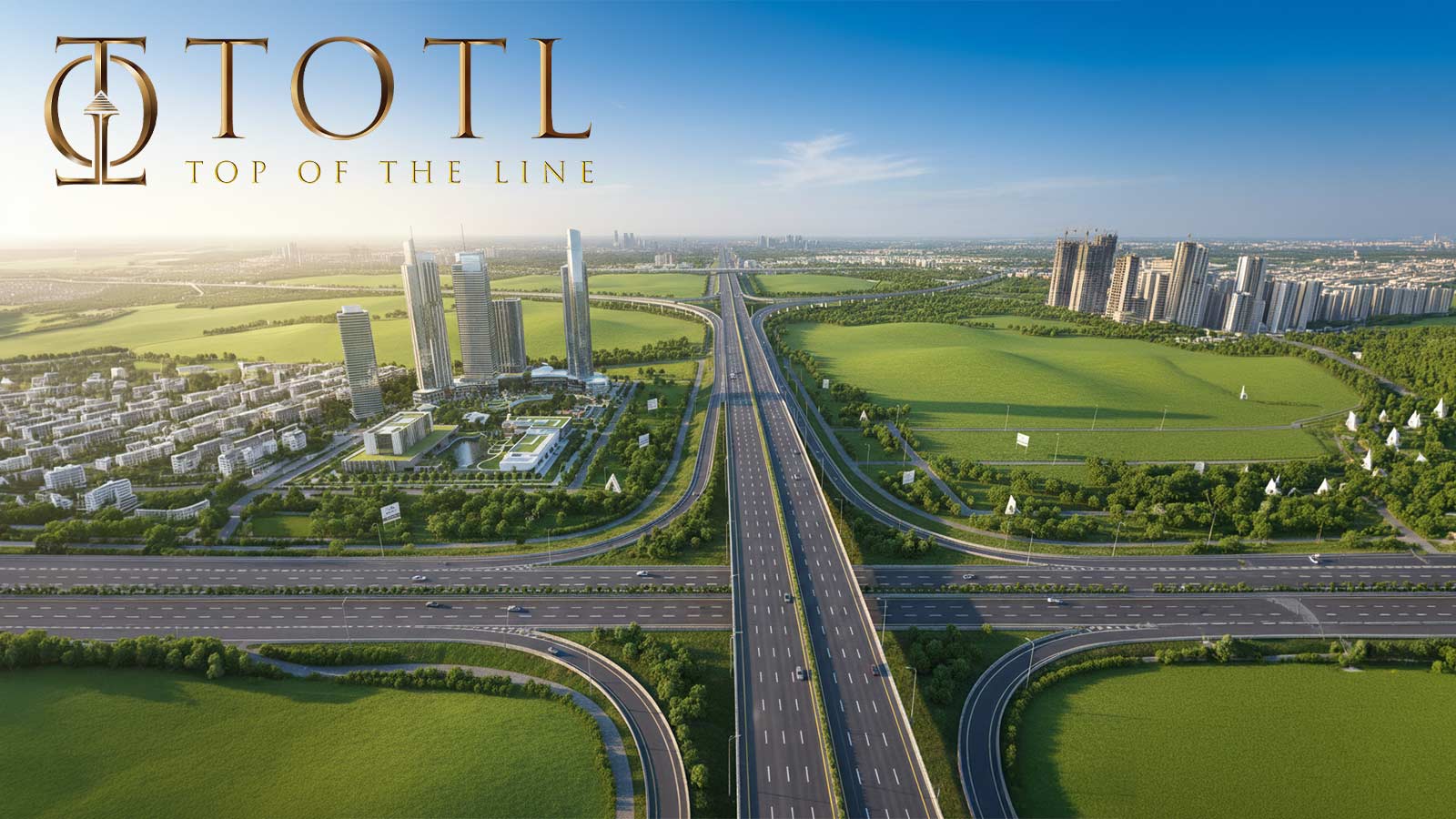

- Expressways and highway expansion

- Dedicated freight corridors

- Airport modernization

- Logistics parks

- Port-led industrial zones

Infrastructure alters accessibility. Accessibility alters demand. Demand influences land valuation.

The National Infrastructure Pipeline (NIP) provides structured insight into ongoing and planned projects.

When infrastructure corridors evolve, adjacent land parcels often experience value discovery well before vertical development matures. This mechanism forms a central pillar of the premium land investment India 2026 thesis.

Why Land Leads Before Construction Cycles

Land operates differently from built assets.

1. Scarcity is Structural

Urban expansion increases demand, but prime land remains finite. According to global urbanization data from the World Bank. As cities expand, peripheral corridors with infrastructure visibility become strategic accumulation zones.

2. No Depreciation Curve

Buildings age. Land does not deteriorate physically. This durability strengthens the long-horizon case for premium land investment India 2026.

3. Optionality

Land can remain passive, be developed, leased, or joint-ventured. This flexibility is absent in fully built, highly leveraged inventory.

4. Lower Operational Risk

Land ownership reduces tenant management, structural maintenance, and construction execution risk.

During rate pivots, these attributes often elevate premium land investment India 2026 within asset allocation discussions.

The Inflation Hedge Logic

Inflation erodes purchasing power. Investors respond by allocating toward assets that retain intrinsic value.

RBI macroeconomic data and inflation commentary can be reviewed.

Land offers:

- Finite supply

- Physical tangibility

- Alignment with economic expansion

- Limited daily mark-to-market volatility

Unlike gold — which offers a hedge but no development optionality — land combines store-of-value characteristics with strategic flexibility. This dual nature reinforces the role of premium land investment India 2026 as both defensive and opportunistic.

Governance and Digitization: Reducing Historical Risk

Land acquisition in India has historically required careful due diligence. Over the past decade, digitization reforms have strengthened transparency.

The Digital India Land Records Modernization Programme (DILRMP) details structured reforms.

Supporting updates from the Press Information Bureau are available.

Digitization enhances:

- Title traceability

- Mutation tracking

- Encumbrance clarity

- Record accessibility

While diligence remains essential, systemic modernization has strengthened the institutional viability of premium land investment India 2026.

Behavioral Shifts Among HNIs in 2026

Private wealth strategies have evolved.

Key trends observed across advisory ecosystems include:

- Reduced speculative leverage

- Preference for freehold ownership

- Low-density asset demand

- Multi-generational planning

For HNIs, land is rarely about rental yield alone. It is about:

- Legacy transfer

- Inflation resilience

- Strategic patience

- Capital preservation

These priorities align naturally with the long-horizon logic of premium land investment India 2026.

A Disciplined Framework for Evaluating Premium Land

Investors considering premium land investment India 2026 should apply structured filters:

Infrastructure Visibility

Track projects under the National Infrastructure Pipeline.

Title Clarity

Verify ownership history and encumbrances.

Zoning Compliance

Understand land classification and permissible usage.

Access and Connectivity

Road access, utilities, and future corridor alignment.

Exit Optionality

Identify probable future buyer profiles.

Holding Horizon

Land rewards patience; short-term speculation increases volatility.

Approached with research discipline, premium land investment India 2026 transitions from narrative to strategy.

Land vs Gold vs Equities: Portfolio Context

Asset | Volatility | Yield | Hedge Strength | Optionality |

Equities | High | Variable | Medium | Moderate |

Gold | Medium | None | High | Low |

Land | Low–Moderate | Optional | High | High |

A diversified portfolio does not rely on one asset. Instead, it balances growth, protection, and resilience.

Within this framework, premium land investment India 2026 acts as a stabilizing anchor rather than a speculative accelerator.

FAQs

1. What does the RBI rate pivot in 2026 mean for premium land investment India 2026?

The RBI rate pivot in 2026 reflects a calibrated shift in monetary stance after inflation stabilization. When rate cycles move from tightening to neutral or accommodative phases, liquidity expectations improve and borrowing conditions stabilize.

Historically, such transitions influence asset allocation behavior. Real assets, particularly land, often attract early positioning before construction cycles accelerate. This is because land banking precedes development expansion.

Investors can review official monetary policy releases directly on the RBI website.

In this context, premium land investment India 2026 is being evaluated as a long-horizon allocation aligned with liquidity normalization and infrastructure momentum rather than short-term speculation.

2. Why can premium land investment India 2026 perform differently from apartments during rate transitions?

Apartments and built properties are influenced by:

- Construction costs

- Developer leverage

- Inventory overhang

- Depreciation and maintenance

Land behaves differently because it:

- Does not depreciate structurally

- Has finite supply

- Benefits early from infrastructure visibility

During rate transitions, developers often secure land banks before launching vertical projects. This early-stage positioning can strengthen the case for premium land investment India 2026 compared to under-construction inventory.

Urban expansion data and infrastructure growth trends can be studied.

3. How does Union Budget capital expenditure impact premium land investment India 2026?

The Union Budget’s emphasis on capital expenditure (capex) drives infrastructure expansion — including highways, freight corridors, airports, and logistics hubs.

Infrastructure improves connectivity. Connectivity increases demand. Demand influences land valuation.

Official Union Budget documentation is available.

The National Infrastructure Pipeline (NIP) provides project-level visibility.

When evaluating premium land investment India 2026, investors often track infrastructure corridors to understand long-term appreciation potential.

4. Is premium land investment India 2026 considered an inflation hedge?

Land is widely viewed as a store of value because:

- It is finite

- It does not structurally depreciate

- It aligns with economic expansion

RBI inflation data and macroeconomic outlook reports provide context for purchasing power trends.

While no asset guarantees protection, premium land investment India 2026 is frequently positioned within portfolios as a tangible hedge against long-term inflation erosion, particularly when held over extended timeframes.

5. How has digitization improved the safety of premium land investment India 2026?

Land governance reforms under the Digital India Land Records Modernization Programme (DILRMP) have improved transparency.

Key benefits include:

- Digitized land records

- Improved mutation tracking

- Better encumbrance visibility

Official program details.

Supporting updates via PIB.

Although due diligence remains critical, modernization strengthens institutional confidence in premium land investment India 2026 compared to earlier decades.

6. What risks should investors consider in premium land investment India 2026?

Like all asset classes, land carries risks, including:

- Title disputes

- Zoning limitations

- Liquidity timelines

- Holding costs

Investors should:

- Verify ownership chain

- Check encumbrance certificates

- Confirm zoning classification

- Track infrastructure progress

Official land record digitization frameworks can be referenced.

A disciplined evaluation approach reduces avoidable risks in premium land investment India 2026.

7. Is premium land investment India 2026 suitable for NRIs and family offices?

NRIs and family offices often seek:

- Long-horizon assets

- Capital preservation

- Tangible holdings within India’s growth story

Land offers optionality — it can remain passive, be developed, or be monetized during infrastructure maturity.

RBI regulations governing NRI investment frameworks can be reviewed.

Within a diversified portfolio, premium land investment India 2026 may complement financial assets when structured appropriately and aligned with regulatory compliance.

8. What holding period makes premium land investment India 2026 meaningful?

Land typically rewards patience. Infrastructure development cycles often span 5–10 years from announcement to operational maturity.

The National Infrastructure Pipeline portal provides insights into project timelines.

Short-term speculation increases volatility. A long-term perspective strengthens the thesis behind premium land investment India 2026 as a strategic allocation rather than a trading instrument.

9. How does premium land investment India 2026 compare to gold or equities?

Each asset serves a purpose:

- Equities: Growth potential but higher volatility

- Gold: Defensive hedge but limited productive optionality

- Land: Scarcity-driven value with development flexibility

Within diversified wealth strategies, premium land investment India 2026 is often evaluated as a stabilizing anchor — not a replacement for financial markets, but a complementary allocation.

10. What macro indicators should investors monitor when evaluating premium land investment India 2026?

Key indicators include:

- RBI policy stance and repo rate decisions

- Inflation trends

- Union Budget capex allocations

- Infrastructure pipeline progress

- Urbanization expansion

Monitoring these macro signals helps investors assess the evolving environment surrounding premium land investment India 2026 and make informed, research-backed decisions.

The Strategic Alignment of 2026

(Expanded to ~700+ words, analytical, investor-grade, and naturally integrating the focused keyword premium land investment India 2026 without sounding forced. No criticism of any location, product, or regulation.)

The Strategic Alignment of 2026: Why Macro Forces Are Converging

Every decade presents a few rare alignment points — moments when monetary policy, fiscal expansion, governance reform, and demographic momentum move in the same direction.

India in 2026 represents one of those moments.

The conversation around premium land investment India 2026 is not emerging in isolation. It is forming at the intersection of four powerful structural forces:

- Monetary normalization

- Infrastructure acceleration

- Governance digitization

- Urban and demographic expansion

When these forces align, capital allocation decisions tend to become strategic rather than speculative.

1. Monetary Normalization: Stability Over Shock

After a disciplined tightening phase, the Reserve Bank of India has signaled calibrated moderation in its monetary stance. Investors can review official policy documentation directly from the RBI.

Rate stability does not create instant booms. Instead, it reduces uncertainty. And uncertainty reduction is often the first signal for long-term capital positioning.

In periods where borrowing costs stabilize:

- Developers begin forward land acquisition.

- Institutional investors reposition for medium-term growth.

- HNIs rebalance portfolios toward tangible stores of value.

This environment strengthens the analytical case for premium land investment India 2026, particularly for investors who prioritize capital preservation alongside growth alignment.

2. Fiscal Expansion: Infrastructure as a Value Multiplier

Monetary stability alone does not create asset cycles. It must be paired with fiscal momentum.

India’s Union Budget continues to prioritize capital expenditure as a growth engine. Official budget documentation can be accessed.

Large-scale capex supports:

- Expressway networks

- Industrial corridors

- Logistics hubs

- Airport modernization

- Port-led development

Infrastructure changes geography. Geography changes value.

The National Infrastructure Pipeline provides project-level transparency.

As corridors evolve, land positioned along connectivity nodes often undergoes early price discovery. That is why premium land investment India 2026 is increasingly analyzed through the lens of infrastructure adjacency rather than short-term sentiment.

3. Governance Reform: Structural Transparency

Land in India has historically required careful diligence. Over the past decade, digitization and modernization initiatives have improved systemic clarity.

The Digital India Land Records Modernization Programme (DILRMP) outlines these reforms.

Supporting updates are available via PIB.

Digitization enhances:

- Record accessibility

- Ownership traceability

- Mutation visibility

- Encumbrance clarity

While due diligence remains essential, governance reform strengthens institutional confidence. The conversation around premium land investment India 2026 is therefore grounded not only in scarcity, but also in improved documentation transparency.

This shift from opacity to traceability has quietly increased the credibility of land as an allocatable asset class.

4. Demographic and Urban Expansion

India’s demographic momentum continues to reshape housing, logistics, and industrial demand patterns.

According to global urban development insights from the World Bank.

Urban population expansion increases pressure on land supply, particularly in infrastructure-linked growth corridors.

As cities expand outward rather than vertically alone, peripheral zones with connectivity potential gain importance.

This demographic shift adds structural depth to the thesis behind premium land investment India 2026, reinforcing its long-horizon viability.

5. Capital Behavior in Alignment Phases

When monetary, fiscal, governance, and demographic trends align, capital tends to behave differently:

- It becomes patient rather than reactive.

- It prioritizes scarcity over short-term yield.

- It seeks tangible, inflation-aligned stores of value.

This is not about aggressive speculation. It is about strategic positioning.

In 2026, premium land investment India 2026 sits at the intersection of:

- Rate stability

- Infrastructure momentum

- Regulatory modernization

- Expanding urban demand

Few asset classes simultaneously align with all four forces.

6. Why This Alignment Matters for Long-Term Investors

HNIs and family offices typically allocate with generational timeframes in mind. For such investors, volatility management and capital durability often outweigh short-term appreciation spikes.

Land’s attributes during alignment phases include:

- Finite supply

- Low daily volatility

- Optional development pathways

- Infrastructure-linked appreciation

- Inflation resilience

When evaluated within the macro context rather than isolated transactions, premium land investment India 2026 emerges as a strategic hedge positioned within a broader economic growth narrative.

7. The Patience Premium

Infrastructure-led appreciation is not immediate. It unfolds across development phases — announcement, approval, execution, and operationalization.

This staged growth favors investors with:

- Long holding capacity

- Risk-filtering discipline

- Infrastructure visibility

The strategic alignment of 2026 rewards patience rather than speed. That patience premium reinforces the structural logic of premium land investment India 2026 as a wealth preservation instrument aligned with India’s macro trajectory.

Final Reflection on 2026

The uniqueness of 2026 does not lie in dramatic headlines. It lies in quiet alignment.

- Monetary stability reduces uncertainty.

- Fiscal expansion fuels corridors.

- Governance reform enhances transparency.

- Demographic expansion sustains demand.

Together, these forces create a macro backdrop in which premium land investment India 2026 transitions from narrative to structural thesis.

In investment history, rare alignment phases often define long-term wealth outcomes — not because they are loud, but because they are foundational.