Upcoming Airports in India 2025: The Ultimate Real Estate Gold Rush

India’s Aviation Revolution is Fueling a Real Estate Renaissance

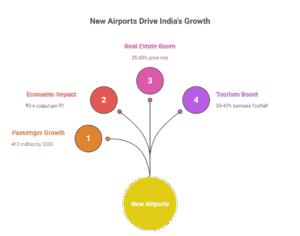

India is entering an aviation-led development era unlike any before. Upcoming Airports in India 2025 are set to transform the country’s air network, connecting remote cities, driving tourism, and sparking an unprecedented real estate boom near airports in India. With over 21 new airports scheduled to open by 2025, India’s Upcoming Airports are not just improving air travel — they are reshaping urbanization, property demand, and investment corridors across the nation.

The government’s UDAN (Ude Desh Ka Aam Nagrik) scheme and National Infrastructure Pipeline (NIP) have made aviation the centerpiece of India’s growth vision. As per the Ministry of Civil Aviation (MoCA), India aims to have over 200 operational airports by 2030, with 50+ upcoming airport projects in India 2025 under construction or expansion. This network will connect metros with Tier-2 and Tier-3 cities, turning areas around India’s Upcoming Airports into future-ready real estate hubs.

So, what does this mean for investors, developers, and homebuyers? Simply put: the next wave of India’s airport real estate investment in India is taking off near Upcoming Airports in India 2025.

- Upcoming Airports in India 2025 and Their Impact on Real Estate Growth

India’s aviation market has become the third-largest in the world, as per Invest India. The country’s domestic passenger traffic is expected to reach 412 million by 2035, nearly doubling today’s figure.

To support this growth, the government has launched massive infrastructure programs:

- UDAN 5.0: Focused on affordable regional air connectivity.

- Greenfield Airport Policy: Encouraging private investment in airport development.

- Public-Private Partnerships (PPP): Attracting global infrastructure firms like Adani, GMR, and Zurich AG.

Each new airport is built with multi-modal connectivity — integrating expressways, metro lines, high-speed rail, and logistics corridors. This multiplies land value and accelerates airport corridor real estate investment in the surrounding regions.

📊 Example: According to NITI Aayog, every ₹1 invested in aviation infrastructure generates ₹3–4 in economic output and 6 direct jobs.

This means that every new airport creates a ripple effect across local economies, from land prices to employment to housing demand. With India’s Upcoming Airports, this impact will expand nationwide.

- Why Upcoming Airports in India 2025 Are Transforming Property Investment

Traditionally, real estate demand clustered around metros like Delhi, Mumbai, and Bengaluru. But as Upcoming Airports in India 2025 take shape in cities like Surat, Rajkot, Udaipur, Shirdi, Jharsuguda, and Dibrugarh, growth is decentralizing.

These new aviation hubs are becoming micro-cities — self-sustained ecosystems that combine:

- Residential townships for aviation professionals and migrants

- Logistics parks and industrial hubs for manufacturing and e-commerce

- Retail complexes, schools, and healthcare facilities

📈 According to Economic Survey 2024, land prices near operational airports rise between 25–60% within three years of the airport’s inauguration.

That’s why forward-thinking investors are turning their attention to airport-adjacent zones, which combine fast ROI potential with long-term sustainability. Jewar Airport real estate opportunities are a prime example of this trend.

- Top Upcoming Airports in India 2025 Creating Property Hotspots

The connection between aviation and real estate goes beyond transport — it drives lifestyle, economy, and tourism.

The Ministry of Tourism reports that every new airport increases local tourism footfall by 35–45%. For instance:

- Mopa Airport, Goa: Sparked luxury villa projects and eco-resorts in North Goa.

- Shirdi Airport: Boosted spiritual tourism and hospitality real estate by 60%.

- Pakyong Airport (Sikkim): Made Himalayan tourism accessible year-round.

- Rajkot International Airport: Attracted new industrial and housing projects.

- Navi Mumbai International Airport property growth is driving residential and commercial projects in Panvel and Ulwe.

In addition, these airports generate direct and indirect employment — from airline staff and logistics to construction and hospitality — which in turn creates demand for residential and rental properties.

So, the rise of India’s Upcoming Airports means not just connectivity but also community creation and prosperity.

- How Upcoming Airports in India 2025 Are Fueling the Real Estate Boom

Airport | Location | Developer | Real Estate Impact |

Noida International Airport (Jewar) | Uttar Pradesh | Zurich AG | Massive land value rise along Yamuna Expressway; Jewar Airport real estate opportunities |

Navi Mumbai International Airport (NMIA) | Maharashtra | Adani Group | Growth in Panvel, Ulwe, and Kharghar; Navi Mumbai International Airport property growth |

Mopa Airport | Goa | GMR | North Goa tourism and luxury realty boom |

Rajkot International Airport | Gujarat | AAI | Expansion of industrial estates |

Dibrugarh Airport | Assam | AAI | Northeast logistics and housing growth |

Shirdi Airport | Maharashtra | State Govt. | Pilgrimage-linked hospitality |

Udaipur Airport (Expansion) | Rajasthan | AAI | Boost in resort and hotel properties |

Each of these airports represents a growth corridor where infrastructure meets investment potential.

For the full government-approved project list, visit the AAI Development Portal.

- Government Support: Policies Driving India’s Upcoming Airports and Realty Growth

Several flagship government programs are fueling India’s Upcoming Airports and airport real estate investment in India:

- UDAN Scheme: Subsidized air routes connecting remote cities.

- Smart City Mission: Integrating airports into sustainable urban plans.

- National Monetization Pipeline (NMP): Attracting private investment in infrastructure.

- Make in India (Aviation): Promoting indigenous production of airport equipment.

- Ease of Doing Business (EODB): Simplified land and construction approvals.

Additionally, many Special Economic Zones (SEZs) and logistics parks are being developed near airports, as supported by Invest India.

This government focus ensures that areas near Upcoming Airports in India 2025 will continue to receive policy and financial backing for decades.

- Why Investors Are Targeting Airport-Influence Zones Near Upcoming Airports in India 2025

From Panvel to Jewar, one trend is clear: proximity to Upcoming Airports in India 2025 equals profitability.

Benefits for Investors:

- Higher rental yield: 6–9% in airport corridors

- Faster capital appreciation: Up to 25% in 3 years post-commissioning

- Mixed-use developments: Office + retail + housing integrated zones

- Better liquidity: High resale potential due to infrastructure demand

Examples:

- Panvel (NMIA): Property prices jumped 55% in 3 years; Navi Mumbai International Airport property growth contributed.

- Jewar (Noida): Land rates on Yamuna Expressway rose over 500% since 2020 (Economic Times).

For investment-ready zones, explore TOTL Realty Projects.

- Connectivity: The Backbone of Real Estate Growth Around Upcoming Airports in India 2025

Infrastructure doesn’t stop at the runway. National Highways Authority of India (NHAI) and Indian Railways are ensuring seamless integration between air, road, and rail networks.

Key corridors include:

- Delhi–Mumbai Expressway: Connecting NMIA and Jewar hubs

- Goa–Mumbai Coastal Highway: Direct access to Mopa Airport

- Mumbai Trans Harbour Link (MTHL): Reducing travel time from Mumbai to NMIA to just 25 minutes

- High-Speed Rail Corridors: Linking airports with urban centers

Accessibility remains the number one factor for airport corridor real estate investment and India’s Upcoming Airports success.

- Future-Ready Trends Emerging Around Upcoming Airports in India 2025

- Aerotropolis Development – Entire mini-cities built around airports integrating business districts, hotels, logistics, and homes.

- Sustainable Housing – Green buildings and eco-townships aligning with Parivesh Portal environmental norms.

- Luxury & Transit Hotels – Premium hospitality chains investing near new airports (e.g., Taj, Lemon Tree).

- Smart Logistics & Warehousing – E-commerce and freight companies investing in airport-adjacent warehouses.

These trends are turning India’s Upcoming Airports into innovation hubs for urban transformation.

- Long-Term ROI Outlook for Upcoming Airports in India 2025

According to PIB India and RERA India, airport-linked real estate projects are among the top-performing asset classes for the next decade.

- Short-term ROI (3–5 years): 25–40% growth in land value

- Long-term ROI (7–10 years): 60–90% cumulative return

- Rental income: Higher due to business travel and tourism

Investors are advised to focus on title-clear plots, developer reputation, and infrastructure completion timelines to minimize risk and maximize gains.

- The Future of Airport Corridors: India 2030 Vision

By 2030, airport-centric zones are projected to become India’s new growth districts — similar to Singapore’s Changi or Dubai’s DXB models.

Upcoming Airports in India 2025 will be the backbone of this transformation.

Emerging opportunities include:

- Affordable housing for airport workers and service providers

- Tourism-driven real estate in coastal and hill airports

- Commercial and IT parks for airport-linked industries

In short, airports will no longer be just terminals — Airports will evolve into economic ecosystems powering India’s trillion-dollar dream.

Take Off Before the Market Does

The message is clear — Upcoming Airports in India 2025 are the launchpads for the nation’s next real estate boom near airports in India.

From Jewar to Goa to Navi Mumbai, every runway is paving the path for new cities, jobs, and opportunities. Investors who act early will benefit the most, as airport corridor real estate investment transforms India’s new wealth hubs.

✈️ Whether you’re a first-time buyer, investor, or developer, India’s Upcoming Airports are your ticket to long-term growth.

💼 Learn more and explore verified projects at TOTL Realty’s Real Estate Hub.