Table of Contents

ToggleVillas in Goa Are Selling Out Fast for 2025 Airbnb Bookings — The Gold Rush Has Truly Begun

Goa’s luxury villa rental market has officially entered a new era — the 2025 gold rush.

Across North and South Goa, premium villas in Goa are already booked out for much of 2025 on Airbnb, SaffronStays, and other short-term rental platforms. What started as a post-pandemic trend of remote living and luxury stays has now matured into a full-blown investment phenomenon.

The data speaks volumes — Goa Airbnb bookings have surged over 40% year-on-year, and luxury villas in Goa are generating some of the highest short-term rental returns in India. Investors, NRIs, and high-net-worth individuals are treating Goa not just as a vacation destination, but as a cash-flowing coastal asset that blends lifestyle with profitability.

And as availability shrinks and nightly rates soar, owning a villa in Goa today isn’t just about luxury — it’s about getting ahead of the next investment wave.

If you’re looking to capitalize on this momentum, this guide will help you decode the numbers, trends, and strategies driving Goa’s short-term rental boom — and how TOTL Realty can help you own a slice of this golden opportunity.

Why 2025 Is the Year of Goa Villas

1. Explosive Airbnb Demand + Rising Tourism

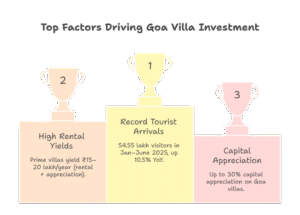

Goa continues breaking records in tourist arrivals. In the first quarter of 2025, the state saw a 10.5% increase over the same period last year. This strong influx directly drives Goa Airbnb bookings, and luxury villas in Goa are among the first to absorb this demand.

- From January to June 2025, Goa welcomed over 54.55 lakh tourists, up from ~50.31 lakh in the same period in 2024.

- In 2024, Goa recorded more than 1.04 crore total visitors (domestic + foreign), outperforming 2023 figures of ~86.28 lakh.

- The Tourism Department of Goa’s own statistics show that Goa attracts millions annually — reinforcing sustained demand for premium stays.

All this flux in footfall drives strong baseline demand — luxury villas are among the first to absorb that demand, especially in peak months.

Meanwhile, your data points hold:

- Airbnb occupancy ~ 47% (Airbtics)

- ADR ~ USD 91 (AirDNA)

- Villas in zones like Assagao / Anjuna yielding ₹15–20 lakh annually (when combining rental plus appreciation)

These numbers are meaningful in a context where tourist volumes themselves are climbing.

2. Scarcity, Regulation & Land Constraints

Beyond sheer demand, supply-side constraints and regulation make ultra-luxury villas rarer — and more valuable.

a) Coastal Regulation & CRZ Zones

- Goa’s Coastal Regulation Zone (CRZ) rules apply to lands within 500 meters from the high-tide line and impose strict controls on what can be built in these zones.

- Strict CRZ rules limit new construction within 500 meters of the high-tide line, making villas in Goa rarer and more valuable. Developers must navigate environmental clearances to secure permission for fully serviced luxury villas Goa.

- In CRZ-I and certain sensitive zones (e.g. ecologically fragile areas), new construction is heavily restricted or disallowed.

- For lands closer to high tide lines (say under 200 m), development is often limited or prohibited.

- The CRZ rules, although relaxed in parts in 2019 to permit regulated infrastructure, still require adherence to environmental criteria, setbacks, and buffer zones.

- Developers are required to acquire CRZ and environmental clearances for projects in affected zones.

Hence, even if there’s land close to beaches, obtaining permission for a fully serviced luxury villa is not trivial — which limits supply.

b) Building Regulations & Local Controls

- The Goa (Regulation of Land Development and Building Construction) Act, 2008 governs how much can be built (FAR, setbacks, height) in Goa.

- In certain areas, additional FAR (floor-area ratio) benefits are allowed for 4- & 5-star hotel projects.

- Town and Country Planning and zoning laws further restrict land-use changes; not all land parcels are permitted for tourism / short-term rental uses.

- Some newer regulation tightening is happening: Goa authorities are increasing enforcement of CRZ violations and mandating sustainability / green building norms for premium properties.

These constraints elevate the barrier to entry and make well-permitted villas more valuable — thus contributing to scarcity.

c) Government Policies & Beach / Shack Regulations

- In 2024, the Goa Regulation and Control of Temporary and Seasonal Structures (under CRZ Ordinance) was promulgated to regulate “shacks” and temporary coastal constructions.

- This shows the government’s awareness of overdevelopment pressure, particularly in tourist zones.

- Also, there is ongoing debate and efforts in Goa to tighten tourist hotspot regulation (e.g. nuisance, environmental protection) to preserve quality of destinations.

All of these interventions tend to curb indiscriminate expansion — preserving premium villa opportunities for those with strong compliance and foresight.

3. NRIs, HNIs & Institutional Demand

- A Knight Frank India report indicates that ~25% of luxury residential buyers consider Goa their favored second-home / vacation-home market.

- The appeal is twofold: owner usage + passive income from rentals.

- Data from Outlook India confirms that, after management costs, short-term rentals often yield better returns than long-term leases, making villa assets especially attractive.

- In Goa’s real estate climate, developers are now factoring in short-term rental viability when designing high-end villas, anticipating that buyers will expect turnkey hosting readiness.

Also, improved infrastructure supports this demand:

- The Manohar International Airport, serving North Goa, enhances connectivity and is already handling millions of passengers annually, making premium villas more accessible this is a boon for Goa Airbnb bookings.

- Government initiatives to boost tourism and international partnerships are further amplifying Goa’s brand as a global destination.

Thus, capital inflows from NRIs and HNIs are reinforcing the momentum.

4. Market Metrics That Amplify the Story

Let’s augment your metrics table with further nuance and depth:

Factor | Range / Data | Notes & Sources |

ADR (Average Daily Rate) | USD 91 – 139 | Reflects baseline villa / short-term rental pricing in Goa markets (AirDNA, AirROI ranges) |

Occupancy Rate | 36% – 47% annually | Highlights variability by micro-location and season |

Peak Nightly Rates | ₹20,000 – ₹35,000+ | In premium zones or during major festivals |

Annual Rental Yield | 5% – 8% | For properly managed assets, in prime micro-markets |

Capital Appreciation | Up to 30% | In select high-demand, limited stock zones |

Top Micro-Markets | Assagao, Anjuna, Siolim, Morjim, Saligao | These tend to command high premiums and better consistency |

One more useful addition: Tourism growth itself as a supporting metric — e.g.:

- Goa’s visitor base is expanding, giving more tailwinds to occupancy and yield.

- The airport expansion, better air connectivity, and state-led promotional campaigns are pushing more high-value travelers to Goa.

All together, these metrics show that not only is 2025 special, but it’s part of a sustained upward trajectory.

Why 2025 Villas Are Already Booked Out

The intersection of soaring demand, supply constraints, and investor behaviors has resulted in many luxury villas in Goa for 2025 being already sold or blocked. Here’s why this market is hotter than ever:

Advance Bookings and Blocks

Investors and groups are securing villas well in advance to guarantee cash flow, reduce vacancy, and ensure their own usage periods. This pre-booking culture is particularly strong among NRIs and HNIs looking for turnkey Airbnb-ready assets. Investors secure luxury villas Goa early for guaranteed cash flow.

Large Group and Event Bookings

Goa’s rise as a destination wedding hub and hotspot for corporate retreats, VIP gatherings, and luxury events has caused early inventory absorption. Villas are snapped up to cater to high-value events, often months ahead. Destination weddings and corporate retreats drive early absorption of villas in Goa.

Trust & Operation-Driven Bookings

Guests increasingly prefer villas with trusted management or recognized brands. Newly launched or lesser-known properties often get bypassed, pushing buyers toward pre-booking top-tier villas. Guests prefer trusted brands, favoring pre-booked luxury villas Goa.

Scarcity of Truly Premium Stock

Mid-range villas may still be available, but ultra-luxury inventory is limited. Scarcity drives early commitments among serious investors. Mid-range villas exist, but ultra-luxury villas in Goa are limited. Sell-outs trigger urgency among buyers targeting Goa Airbnb bookings.

FOMO & Market Psychology

As villas sell out, urgency rises. Fear of missing out (FOMO) triggers further early purchases, reinforcing the sell-out trend.

Strategy to Win in This Red-Hot Market

If you want your villa (or portfolio) to outperform in Goa’s Airbnb ecosystem, follow this competitive playbook:

1. Choose the Right Micro-Location

Not all beachfront land or coastal properties are equal. Focus on:

- Access: Proximity to roads, airports, and key beaches.

- Differentiation: Quiet, boutique, or scenic areas.

- Future Growth: Infrastructure developments, connectivity, and tourism projects.

- Complementary Attractions: Lifestyle, dining, and cultural hotspots.

Top micro-markets include Assagao, Morjim, Siolim, Sawantwadi, with premium beach adjacency in Nagoa, and urban/cultural appeal in Panaji.

2. Build to Premium Standards

Beyond aesthetics, your villa must deliver experiences:

- Private pools, landscaped gardens, and terraces.

- Luxe interiors with high-quality fixtures.

- Smart home and tech features.

- Concierge, housekeeping, and security services.

- Spa, wellness, and curated local experiences.

Premium features allow higher nightly rates and maintain occupancy even off-peak.

3. Professional Management Is Non-Negotiable

Operational excellence is critical:

- Dynamic pricing and revenue optimization.

- Guest support, onboarding, and review management.

- Maintenance, cleaning, and upkeep reliability.

- Marketing on top-tier platforms plus direct channels.

TOTL Realty can either build or partner with top-class operators to maximize returns.

4. Smart Booking Strategy

- Reserve inventory for personal use.

- Implement minimum-night rules strategically.

- Open last-minute windows to capture spontaneous bookings.

- Buffer time for seasonal maintenance and upgrades.

5. Brand & Marketing

- Position as a luxury boutique villa, not just a holiday stay.

- Use high-end visuals, storytelling, and authentic guest reviews.

- Optimize SEO for “villas in Goa”, “Goa Airbnb bookings”, and “luxury villas Goa”.

- Leverage influencers, media coverage, and PR campaigns.

6. Exit & Appreciation Strategy

- Plan for a 5–7 year hold to optimize capital appreciation.

- Explore fractional ownership models for liquidity.

- Target HNIs seeking vacation homes for resale opportunities.

FAQs

Q: Are the villas truly sold out?

A: Most fully serviced and branded villas in Goa have 2025 bookings locked. Lesser-known units may still have inventory at lower rates.

Q: What is the yield on a luxury villa in Goa?

A: Yields of 6–8% annually are typical, with combined returns including capital appreciation potentially exceeding 10–12%.

Q: How do regulation and compliance affect Airbnb bookings?

A: Compliance with CRZ, licensing, taxes, and safety approvals is critical for premium villas in Goa.

Q: Minimum nights to allow?

A: Peak season: 3–5+ nights; mid/off-season: 1–2 nights or promotional offers.

Q: Invest now or wait?

A: Early movers secure prime luxury villas Goa and top Goa Airbnb bookings.

The 2025 Villas-in-Goa Gold Rush

Premium villas in Goa, backed by strong operations and marketing, are being snapped up faster than ever. Early movers have a decisive edge in capturing both rental income and capital appreciation.

Partner with TOTL Realty to explore fully managed luxury villas Goa in prime micro-markets like Assagao, Anjuna, and Morjim. Secure your high-yield Airbnb-ready investment today!

Ready to Invest?

Don’t miss your chance in Goa’s 2025 villa gold rush!

Partner with TOTL Realty to explore fully managed luxury villas in prime micro-markets like Assagao, Anjuna, and Morjim. Secure your high-yield Airbnb-ready investment today!